- Mon To Fri 9:00 AM To 5:30 PM

Security Token Offering

September 17, 2021

Crypto Noobs Of 2017 Vs. 2020: Learning To Trade Better Is Getting …

Once tokens integrate with the existing international banking infrastructure and function beneath wise government regulation, they’ll gain the public’s belief. Highly optimistic observers even contemplate that ICOs may substitute Initial Public Offerings as the first share-issuing method. In the case of security tokens, their most common use is as a fundraising automobile in ICOs. When a company raises funds in an Initial Coin Offering (ICO), it does so by issuing tokens which it distributes to buyers interested in contributing with crypto-funds.

Look To Enjoy The Melt Up, But Be Well Prepared For A Melt Down: Investor’s Advantage Corp. President

Securities are traded on inventory exchanges and they’re thought of as property when they’re transferred between traders in secondary markets. As such the STO is within ico vs sto the highlight for its potential as a useful software to permit corporations to digitize assets on the blockchain.

They are anchored to actual securities and token issuers fall beneath the regulatory requirements of the SEC and FINMA which include financial reporting requirements. These measures be sure that the tasks are legitimate https://globalcloudteam.com/blockchain-platform-for-ico-sto/ and developers received’t disappear together with your cash. Debt safety holders typically obtain interest payments on the principal.

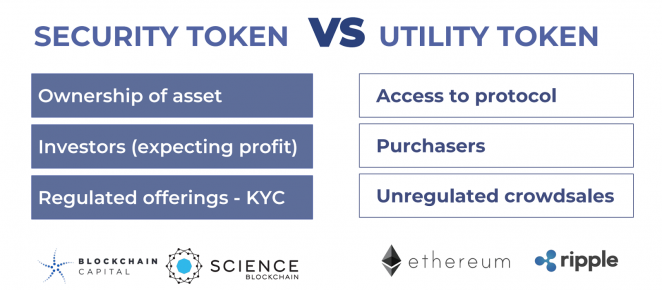

The holders of those safety tokens could have extra power and safety than the holders of straightforward unregulated utility tokens. Security token holders can have voting rights, dividends rights, the proper to legally sell their capital or curiosity, revenue sharing mannequin, and so on. To simplify, ICOs are merely a token distribution event https://www.luxoft.com/ where buyers invest in BTC or ETH or Fiat in return of the native tokens of that exact project. And this token can characterize a hell lot of issues corresponding to pre-bought rights to access the service when the product is ready or a income sharing token and so on.

Some individuals believe that STOs, will ultimately completely exchange the original Initial Coin Offerings (ICOs). Others imagine that STOs of their current kind really take away from plenty of the original positives that crowdfunding via an ICO provided. The process of launching an ICO fundraising campaign is simple to start out, you just announce it and perform a digital campaign. There’s no entry barrier for neither sellers or buyers, it’s open to crowd investing.

Once the ICO is launched and has a defined timeline, the investors should buy the tokens. The groups have the liberty to use the funds in the way in which they deem most useful. Later, the tokens are distributed in a simple automated method via smart contracts. A security token is a digital asset that derives its value from an external asset that can be traded.

This sinks the already weak argument that ICO members are “buyers” in younger firms and opens the door to new ideas like that of The Elephant. The aptly named ‘utility tokens’ are the results of an ICO whereby customers of a blockchain platform pay with the tokens purchased in the midst https://ru.wikipedia.org/wiki/EPAM_Systems of the ICO, or that they earn for providing another related input. Golem is a pertinent instance, permitting users to lend their very personal PC’s power to the group which collectively employs it to run a distant supercomputer.

Subscribe To Receive Our Top Stories Here.

Therefore, these tokens are topic to federal laws that govern securities. Failure to adjust to these laws might lead to severe consequences including penalties and potential derailment of the development of a project. ICOs may fall exterior current regulations, depending on the nature of the project, or be banned altogether in some jurisdictions, corresponding ico vs sto to China and South Korea. A council created by some of the main cryptocurrency exchanges – Crypto Ratings Council – seems to agree as it awarded XRP a 4 out of five in matching the criteria thought of to be a safety. It pointed out that Ripple bought XRP earlier than the token had any utility and used a securities-like language when promoting XRP.

- To launch an STO, it takes more time to get the regulators on board and carry out the mandatory tokenization of the property.

- An initial coin providing (ICO) or initial currency offering is a sort of funding using cryptocurrencies.

- Later on, the security tokens are going to be traded via broker-sellers supervised by regulatory bodies.

- Normally, it’s restricted to accredited traders solely and the amounts of money required are greater.

- When ICOs are more commonly used to boost funds for a tech product, STOs are more linked to monetary providers.

- Therefore earlier than the thought launch and announcement, the corporate has to provide you with a scalable business model, which makes the tasks more mature and reliable.

Users earn golem community tokens, or GNTs, for connecting to the group, but they can additionally purchase them by the use of an trade. Post that expects to see even the evolution of security tokens into its varied variations corresponding to tokens which might be merely regulated to tokens that ico vs sto are regulated in addition to AML & KYCed with identity management built in them. Not all utility tokens are securities however most are, and a safety token can have a utility, but that doesn’t exempt it from getting regulated. Well, the difference is of authorized rights and safety as I have defined within the above section.

Whats is token?

In general, a token is an object that represents something else, such as another object (either physical or virtual), or an abstract concept as, for example, a gift is sometimes referred to as a token of the giver’s esteem for the recipient. In computers, there are a number of types of tokens.

It’s not as regulated as STO, but in addition the Exchange team would do a better background examine on the project and not lett apparent scams in. Global Cloud Team has extensive knowledge and experience in blockchain and crypto technologies used for ICOs and STOs. We understand that entrepreneurs need to save as much https://globalcloudteam.com/ as potential to launch their product, so we assist you to save on ICO or STO development by utilizing skilled teams in multiple areas all over the world. The most important difference between ICOs and STO, is within the regulation that underpins the STO model.

They describe completely different scenarios where corporations can provide security-tokens to potential patrons. STOs are fixing the largest problem offered by ICOs – the lack of any ensures and compensation if a project fails or seems to be scammy.

Well, even I was when I discovered this for that first time that Bitcoin’s blockchain was used to offer the first coin offerings. 2019 noticed a surge in so-known as IEOs (Initial Exchange Offerings), token gross sales through centralized exchanges.

Potential investors must confirm their accreditation earlier than taking part in an STO. The decrease entry barrier for ICOs, nonetheless, implies that there are no regulatory consequences for funds which are misplaced. Where the 2 diverge as Cointelegraph state, is in the truth that ICOs sell cash, currencies and utilities whereas STOs deals with the sale of asset-backed securities. And despite the fact that these STO tokens are different from most cryptocurrencies, being backed by actual fairness, they nonetheless suffered along with the broader market through the 2018 bear market. STOs are trustworthy, however the excessive barrier to entry makes it unlikely they’ll ever turn out to be wildly in style like the ICO was in 2017.

But briefly again, safety tokens are more regulated and thus protects the rights of investors. And as per the securities regulation of the US STOs have to offer full disclosure as well as proper documentation to the SEC to get totally regulated. And mind you this document needs to be extra detailed than the shitty whitepapers that scammy ICOs have been spitting out randomly.

Can I say Finna?

SI means Standing Instruction. It is an instruction either given by the customer or obtained by the bank (there is a difference) for transfer of funds from one account to another. SI can be set up for loan EMIs, investments like RD or PPF.

Sto Vs Ico: Introducing Stos- Difference Between Sto & Ico

What does ASL mean in logistics?

Why Basic Attention Token (BAT) is a good investment Through Brave, BAT will be used to pay content creators and publishers through tips by loyal fans and users will also earn BAT for viewing ads. Basic Attention Token is one of very few cryptocurrencies with a legit use case and working product.

STOs can also be seen as a hybrid method between cryptocurrency ICOs and the more conventional preliminary public offering (IPO) due to its overlap with each of those methods of investment fundraising. However, given perpetually unstable cryptocurrency market, and its precipitous 2018 slide, it has turn out to be riskier to launch an ICO and depend on circumstances secure sufficient to run a company.